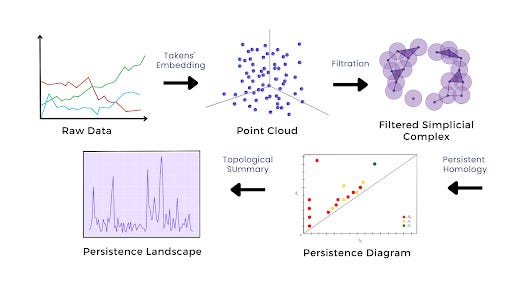

A groundbreaking study was conducted by researchers from the University of the Philippines Diliman. They have revealed a new method for predicting stock market crashes. This study introduced a novel approach to forecasting market downturns. Researchers used Topological Data Analysis (TDA), which is a technique inspired by the geometry of rubber sheets. They managed to predict periods of market instability with remarkable accuracy.

TDA works by identifying clusters, loops, and voids within datasets, revealing underlying patterns that otherwise be obscured. One of the key tools used in TDA is persistent homology, which tracks how these geometric structures change over time. By analyzing the persistence of these structures, researchers can pinpoint significant trends and anomalies.

The study found that as the market approached a crash, the data points began to cluster together. This clustering led to a weakening of the persistence of certain geometric structures. This change in topological structure was indicative of an impending downturn.

The researchers applied TDA to stock price data. This allowed them to create persistence landscapes. These landscapes visually represent the probability of a market crash. These landscapes provided valuable insights into the potential risks linked to different stocks.

The study demonstrated the effectiveness of TDA in predicting market crashes. The researchers emphasized that further research is needed to confirm their findings. They also need to explore its applicability to other markets and time frames.