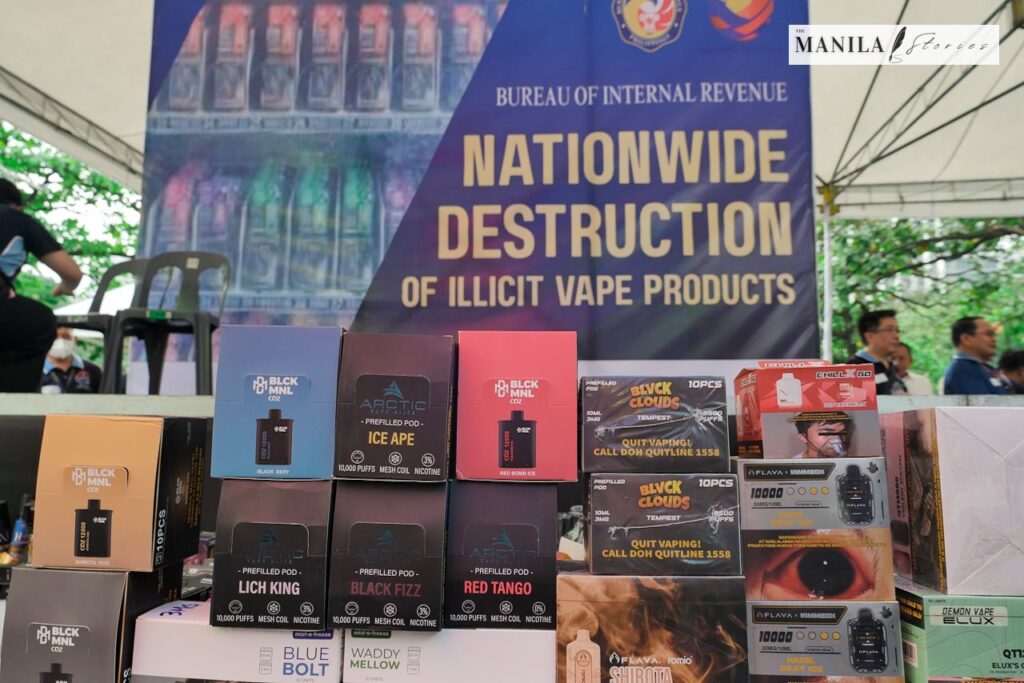

The Bureau of Internal Revenue (BIR) has taken a significant step. It is actively fighting against the illicit trade of excisable goods. The BIR led the destruction of 448,494 units of illicit vape products in a simultaneous nationwide operation. These products were estimated to carry an excise tax liability of $1.34 billion, inclusive of penalties. This move underscores the government’s firm stance against the illegal trade of excisable goods. It also highlights its commitment to protecting public health and revenue.

The destruction of illicit vape products is part of a nationwide operation that is being livestreamed online 24/7. The activity is being carried out over three days, and it follows sustained enforcement operations conducted by the BIR. The operations were conducted according to Section 6(C) of the National Internal Revenue Code of 1997. It was amended and implemented through duly issued Mission Orders.

In total, the BIR seized 742,778 units of illicit vape products found to be in violation of excise tax laws. The products were seized due to non-payment of excise taxes, non-affixture of internal revenue stamps, and non-registration of vape brands. The total estimated tax liability of the seized products amounts to $2.73 billion, inclusive of penalties.

Commissioner of Internal Revenue Charlito Martin R. Mendoza emphasized the importance of conducting the destruction activity publicly and simultaneously nationwide. “The government does not-and will not-tolerate the sale of vape and vapor products without the full and proper payment of excise taxes,” he said. Commissioner Mendoza stressed that excise taxes on vape products and other so-called sin products serve a dual purpose. The first purpose is to regulate consumption by raising retail prices and discouraging use, especially among the youth. The second is to generate revenues that help fund essential public services, particularly healthcare programs.

The absence of excise tax stamps on illicit vape products clearly indicates that these products are unsafe. They are also dangerous. Commissioner Mendoza warned that these unstamped products are evading government oversight. They also undermine the authority of the government to monitor, regulate, and control their sale and distribution. “Illicit vape products cannot simply be taxed and released into the market, as their contents and device safety cannot be assured, particularly with battery-powered devices placed close to the face,” he added.

The destruction of the seized vape products follows Sections 224, 225, and 279 of the Tax Code. These actions align with legislation. This is implemented under Revenue Regulations Nos. 14-2024 and 16-2024. It includes other related BIR issuances governing the seizure, forfeiture, and disposal of excisable goods. The BIR worked closely with the Department of Environment and Natural Resources (DENR). Their goal was to ensure that all destruction activities comply with environmental, health, and safety standards.

The destruction activity was observed by representatives from key government agencies. These representatives included the Department of Finance (DOF), Bureau of Customs (BOC), Department of Trade and Industry (DTI), and the Commission on Audit (COA). The DENR, National Bureau of Investigation (NBI), Philippine National Police (PNP), and Department of Health (DOH) were also present. There were other partner agencies as well. Members of the media were also present.

Commissioner Mendoza reiterated that enforcement efforts will continue to intensify in the coming year. “We will continue to seize, destroy, and permanently remove unstamped vape products from the market to ensure that no one profits by placing consumers at risk,” he said. “Our enforcement actions will be more intensified, coordinated, and uncompromising to protect public health, uphold the law, and safeguard legitimate government revenues.”

The BIR also urged consumers to report the sale of vape products without excise tax stamps. They reminded the public that unstamped vape products are illegal. These products are untaxed and unsafe for use. The Simultaneous Nationwide Destruction of Illicit Vape Products highlights the BIR’s sustained commitment. It shows their effort to combat illicit trade. The BIR also aims to strengthen regulatory compliance and uphold fiscal integrity. These actions support national public health and revenue objectives.

The fight against illicit trade is a continuous effort that requires the cooperation of all stakeholders. The BIR’s move to destroy illicit vape products is a significant step in this direction. It sends a strong message to those involved in the illicit trade that the government will not tolerate their activities. The BIR is dedicated to protecting public health and revenue. It will continue to work tirelessly. Their goal is to ensure that all excisable goods are properly taxed and regulated.

In conclusion, the BIR’s destruction of illicit vape products worth $1.34 billion in unpaid excise taxes and penalties is a significant achievement in the fight against illicit trade. It showcases the government’s commitment to safeguarding public health. Additionally, it demonstrates the government’s commitment to protecting revenue. It acts as a warning to those involved in the illicit trade. The BIR will continue to intensify its enforcement efforts. They want to ensure that all excisable goods are properly taxed and regulated. Those who engage in illicit activities will be held accountable.

The public plays a crucial role in this effort. Consumers should report the sale of unstamped vape products. This helps the BIR identify these products. By doing so, the BIR can seize them. Consumers prevent harm to unsuspecting users. Consumers should report anything suspicious related to the sale of unstamped vape products. The BIR’s hotline and online reporting mechanisms can be used to accomplish this.

As the BIR continues its fight against illicit trade, it is essential to recognize the importance of regulatory compliance. Excise tax stamps on vape products do more than generate revenue. They ensure that these products are safe for consumption. The absence of these stamps is a clear indication that the products are not only untaxed but also unsafe.

The BIR will soon ramp up its efforts to check the market for illicit vape products. They aim to take firm action against those involved in the illicit trade. The agency will collaborate with other government agencies. They will also partner with stakeholders. Their aim is to ensure all excisable goods are properly taxed. They will ensure these goods are regulated effectively. The fight against illicit trade is a collective effort. The BIR is committed to doing its part. They aim to protect public health and revenue.

The destruction of illicit vape products is a significant milestone in the BIR’s efforts to combat illicit trade. It demonstrates the agency’s commitment to upholding fiscal integrity and protecting public health. As the BIR continues to intensify its enforcement efforts, it is essential to recognize the importance of regulatory compliance. Consumers also play a vital role in reporting suspicious activities. We can ensure that all excisable goods are properly taxed and regulated. People involved in illicit activities will be held accountable.